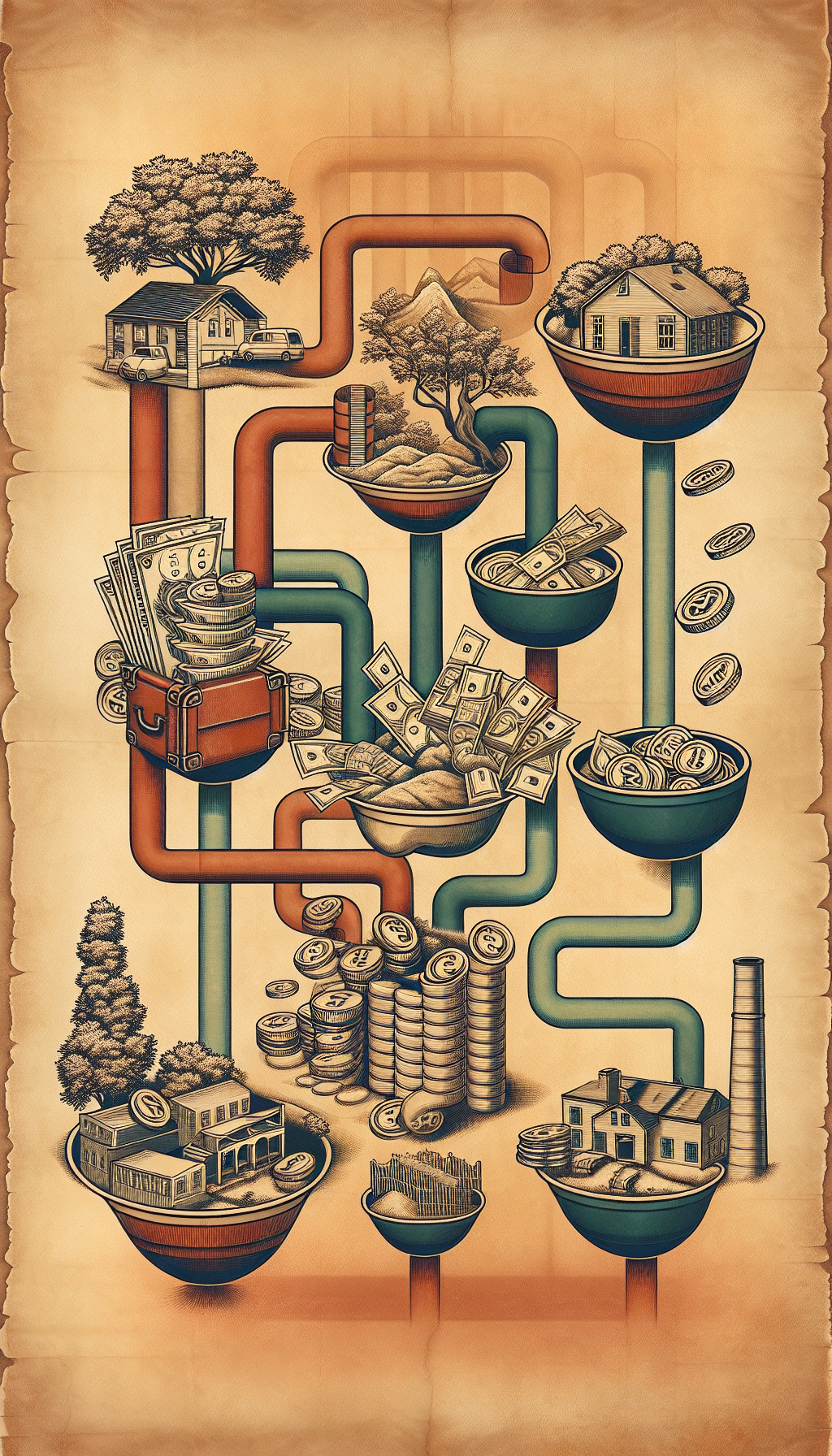

Diversifying your income streams involves having multiple sources of earning. This not merely involves part-time jobs or freelance work, but can also include investments, real estate, and online businesses. Having multiple income streams is a strategic way to ensure you’re not relying on one source for all your financial needs, thereby securing your financial future.

Let’s delve into the different types of income streams that can help diversify your earnings.

1. Earned Income:

Earned income is what you receive from your regular job or business.

It’s the primary source of income for most individuals. However, depending solely on your job or business can be financially risky.

Therefore, it’s advisable to explore additional income-generating avenues.

2. Profit Income:

Profit income is derived from selling a product or service at a higher price than what it cost you to make or acquire.

This could be a traditional business, an online shop, or even flipping real estate properties. The profit generated from these activities serves as another income stream.

3.

Interest Income:

Interest income is generated from lending your money to a bank or other financial institution. A traditional savings account, certificate of deposit, or a money market account are excellent examples of interest income sources.

These are considered safe, but they often generate lower returns.

4. Dividend Income:

Dividend income comes from investments in stocks. If the company you have invested in makes profit, a proportion of that profit is distributed to shareholders as dividends. It’s a great way to earn passive income, but it also involves a certain amount of risk as stock market performance can be unpredictable.

5. Rental Income:

Rental income is generated from owning real estate properties and renting them out. You could rent out residential or commercial properties and earn a steady income.

6. Royalty Income:

Royalty income comes from others using your intellectual property, such as copyrights, patents, trademarks, or even a business model.

This could be a great source of passive income if you’re in the creative field or have innovated a product or a business model.

7. Capital Gains:

Capital gains are the profits you earn from selling an investment or real estate for more than you paid for it. Although not a regular income stream, it can significantly boost your financial resources when it occurs.

In conclusion, diversifying your income streams is a smart strategy to secure your financial future.

It ensures that you’re not solely reliant on your regular job for your financial needs and reduces the risks associated with unforeseen circumstances. It’s important to consider your skills, interests, and the level of risk you’re willing to take when choosing additional income streams.

Remember, creating multiple income streams doesn’t happen overnight, but with patience, diligence, and strategic planning, it’s entirely achievable.