Without a shadow of a doubt, asset allocation stands as one of the most critical aspects in the realm of investment and wealth management.

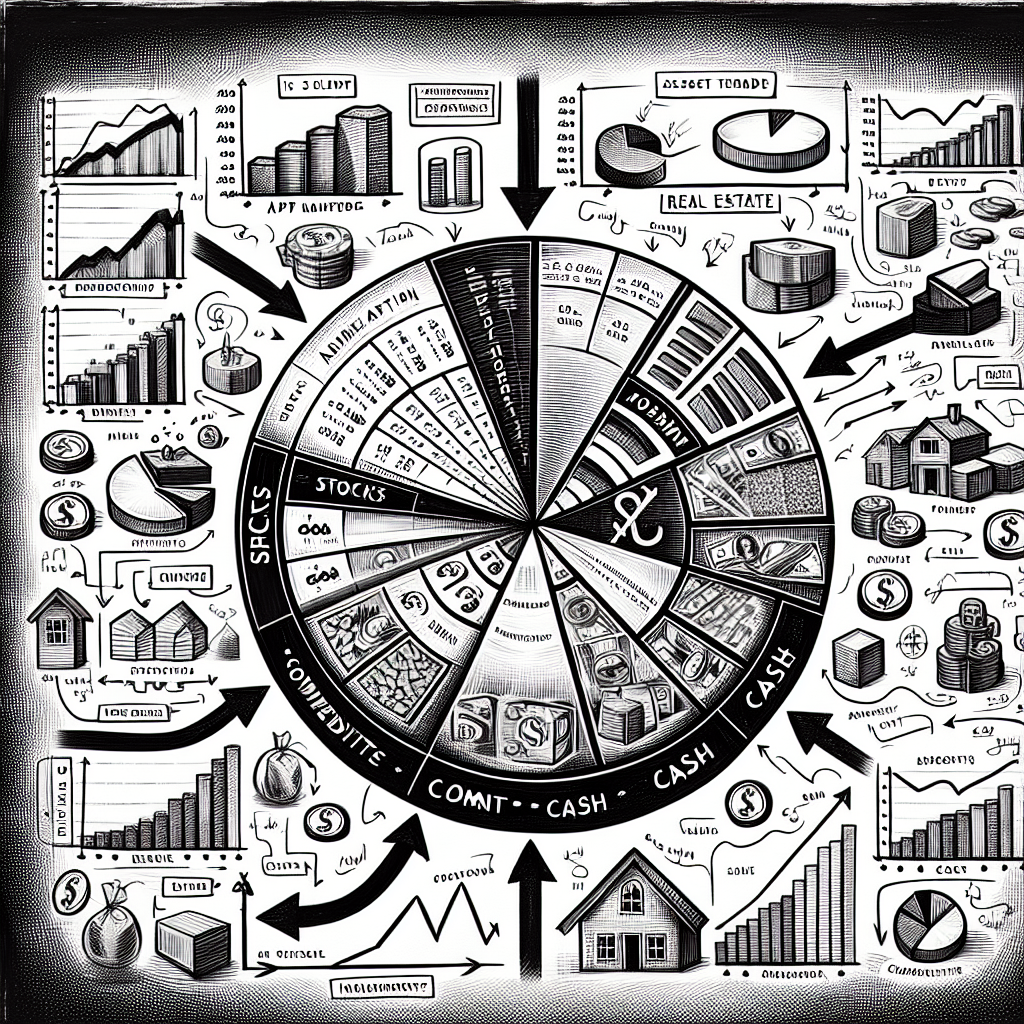

It forms the bedrock upon which successful portfolio management is built, influencing both risks and returns. By distributing investments among different asset classes – equities, bonds, cash, and real estate, to name a few, asset allocation plays a pivotal role in determining the overall portfolio returns.

Understanding the Underpinnings of Asset Allocation

The primary principle of asset allocation is diversification, a concept famously encapsulated in the old adage, “Don’t put all your eggs in one basket.” By spreading investments across a variety of asset classes, it minimizes risk and cushions against market volatility. But it’s not a one-and-done deal; rather, it’s an ongoing process that requires regular review and adjustment according to changing market conditions, goals, and risk tolerance levels.

Risk Tolerance and Investment Horizon: Key Determinants

Risk tolerance and investment horizon are two fundamental factors that shape your asset allocation strategy. If you’re a risk-averse investor, you might opt for a conservative approach, allocating a higher proportion of your portfolio to bonds and cash. On the other hand, risk-tolerant investors might lean towards equities, which, despite their higher volatility, can potentially yield greater returns.

Your investment horizon, or the length of time you plan to hold your investments, is another crucial determinant.

Long-term investors can afford to take on more risk as they have more time to recover from market downturns. They might, therefore, allocate more to equities. Conversely, those with a shorter investment horizon might prefer a more risk-averse approach.

Rebalancing: The Need for Recalibration

Asset allocation isn’t a static concept.

With market fluctuations, the value of your investments can shift, potentially leading to a divergence from your initial allocation. This underlines the need for rebalancing – the process of realigning the proportions of your asset classes to adhere to your original asset allocation.

Here’s an example: Suppose, you initially allocated 60% of your portfolio to equities and 40% to bonds.

Over time, owing to a bullish equity market, the proportion of equities might increase to 70%.

In such a case, you’d need to sell off a portion of your equity holdings and invest more in bonds to restore your original 60/40 allocation.

Strategic and Tactical Asset Allocation: Two Sides of the Same Coin

Asset allocation strategies can be broadly split into two categories: strategic and tactical. Strategic allocation is a long-term, disciplined approach where the allocation is fixed based on investment objectives, risk tolerance, and investment horizon. It is less responsive to short-term market swings and, hence, requires infrequent tweaking.

On the other hand, tactical asset allocation is a more active investment strategy. It involves ongoing adjustments to the asset mix based on market trends and economic forecasts. While this could potentially lead to higher returns, it requires a deep understanding of market dynamics and a higher risk tolerance.

Wrapping It Up

The beauty of asset allocation lies in its versatility.

Whether you’re a conservative investor or a risk-taker, a novice or a seasoned pro, there’s an asset allocation strategy for you.

It’s about finding the right balance that matches your investment goals and risk tolerance. Remember, the key is not to chase returns, but to manage risks. After all, it’s not about timing the market; it’s about time in the market. So, invest time in understanding asset allocation and let your money work smarter, not harder.